September, 2024

On my way east this week I stopped in Elko, Nevada. Being smack in the middle of America’s gold mining motherload region, I wanted to check out oversized dump trucks and meet the people who do the digging for ore. That’s the truck, and those are the people.

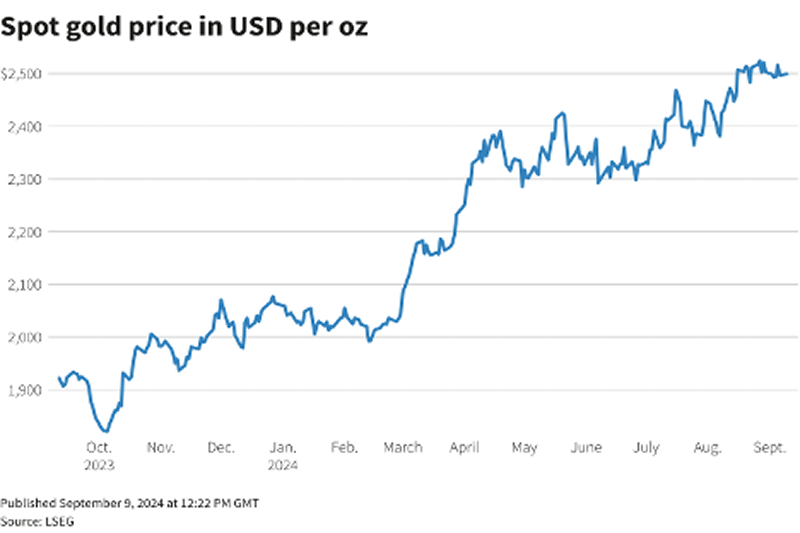

The bigger reason I wanted to visit Elko and the surrounding Carlin Trend, was because the price of gold recently reached an all-time high of $2,500 an ounce. That puts it up a little over 30% in the last twelve months. Not a small move, in such a short period of time, for any asset or class thereof.

For a good long time, like going back almost thirty years, I’ve heard every reason that exists for why to own gold. It was an inflation hedge, a geopolitical hedge, a store of value, cool to look at, something a prepper puts in a doomsday bunker!

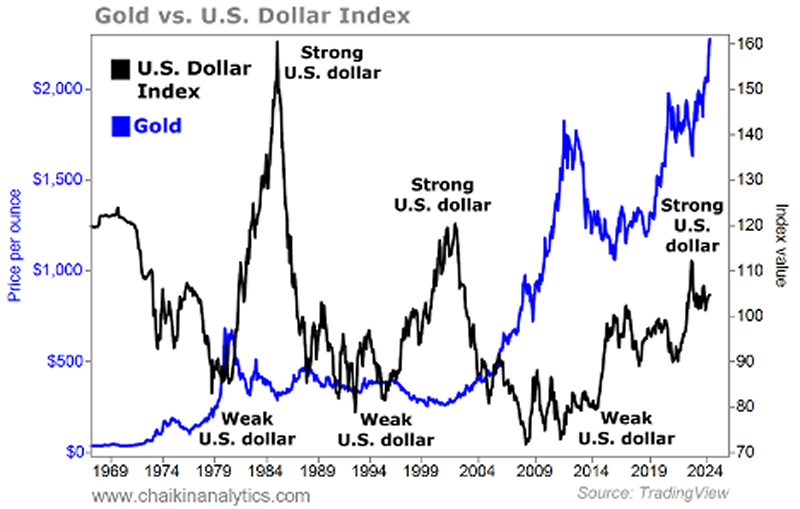

At this point I’m somewhat of the belief that gold is much more like crypto than anything else. It’s valuable because someone else, the buyer, thinks it is more valuable. More, of course, than the seller does. While there used to be a legitimate and reinforced correlation between the weak dollar and high gold prices, that too has broken down over the past few years now. Strength in both is a modern thing, arriving when the pandemic did.

When I sped out east on I-80 after kicking up dust, I was thankful that I stopped to smell the bouillon. This is an interesting part of the world, and if you are into old rocks, the job doesn’t suck nearly as much as one might think. Tired of your desk job? Keep an eye on the next Elko In-Person Career Fair. ‘I like big trucks, and I cannot lie…’

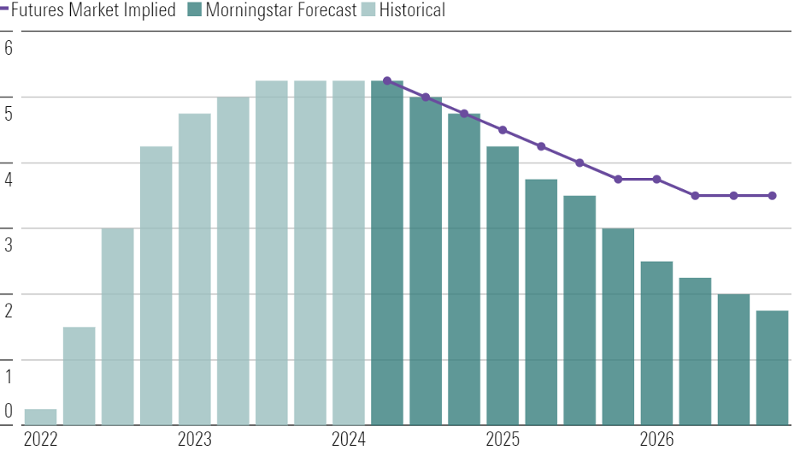

Even those flogged are embarrassed by the flogging that the next rate cutting cycle is getting. It is everywhere, in even the most remote of financial journalism outlets. Is it a quarter point, a half point, and quarter and a half point? Turn down the noise and listen for the back beat. This chart from Morningstar does about as good a job as any to show the glidepath for where the Fed is taking rates. If I can see this properly, that makes year-end 2025 at about 3%, down from the current 5.25%. And a year-end 2026 sub 2%.

As I wrote after Jerome Powell’s speech in Jackson Hole two weeks ago now, there is a pretty good end-zone dance going on right now Eccles building in D.C. Like one the long suffering Deee-troit Lions are doing these days. You earned it, boys!

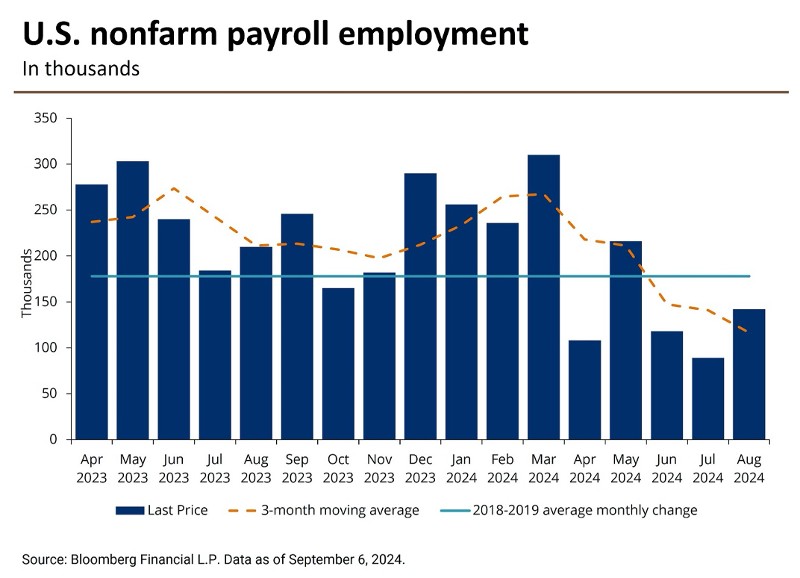

A big reason why the rate bulls are all fired up is the theoretical slowdown in job growth. Since April of this year, we have been running ‘below trend’ to what we have seen in the prior twelve months. If where we are growing now is at all perceived to be showing overall weakness, then the economy has a glass jaw.

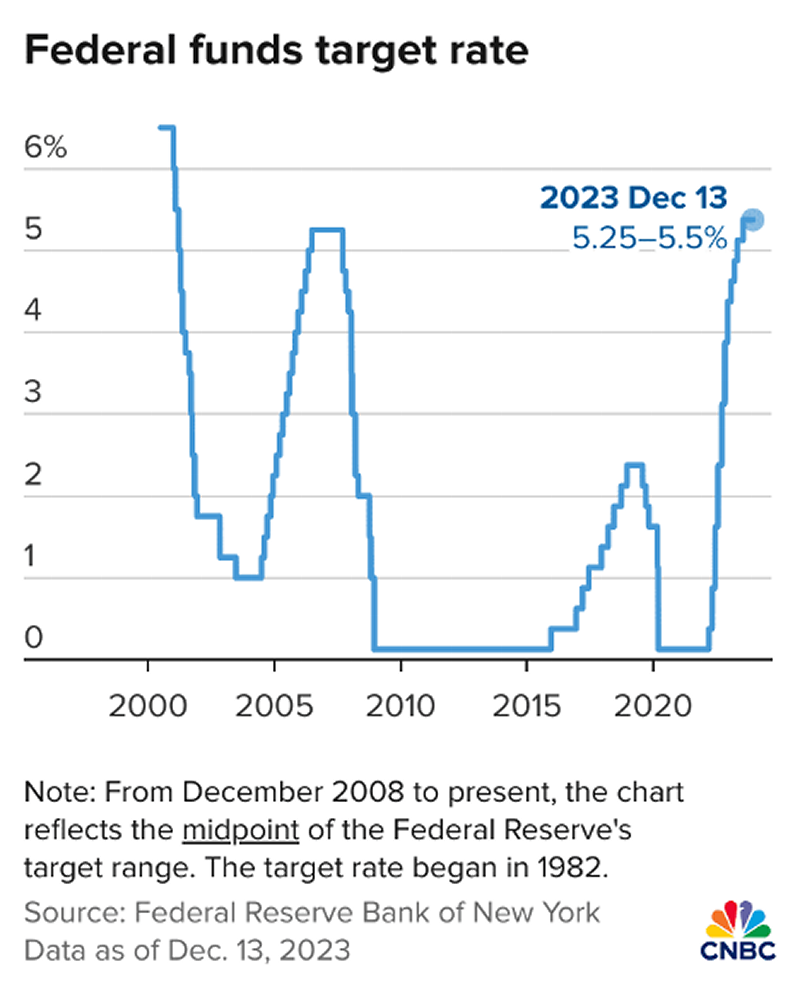

Last thing I I’ll say on rates, and it’s pretty much the same thing I said last year, is that at some point ‘markets have to be markets’. Since 2000, the Federal Reserve has taken us on an absolute wild ride.

Work with me here on how this roller coaster has come about….

2000 – 2004 = Dot.com bust and 9/11. Fed Funds rates go from 6% to 1%

2005 – 2008 = Normalized recovery, economy doing well. Fed Funds rate goes from 1% to 5.25%

2009 – 2010 = Global financial crisis hits Fed goes full reverse as quickly as possible. Fed Funds goes from 5.25% to ‘zero’.

2011 – 2015 = Economy on ‘ZIRP’ (Zero Interest Rate Policy) for four years as the economy sorts itself out and decides what it can look like. Fed Funds stay at ‘zero’.

2016 – 2019 = The monetary powers that be decide ‘ZIRP’ has worked and it’s time to see if ‘Junior’ can walk again. Fed Funds goes from ‘zero’ to 2.25%

2019 – 2021 = The Covid-19 pandemic hits globally and the world debt markets freeze up. The Federal Reserve once again goes into immediate and full revers. Fed Funds rates go from 2.25% to ‘zero’ almost overnight.

2021 – 2024 = Somebody, or many bodies, realize that a ‘policy error’ has occurred and inflation in the double digits is headed our way. Fed funds go from ‘zero’ to 5.25%

This isn’t a sound long term monetary policy, yet it’s what we’ve had going on for going on for the past twenty five years. Forget Mr. Toad, it’s us that have been on the wild ride.

Here is my plea, this time. Dear Jerome, Thomas, John, Thomas, Michael, Raphael, and Michelle, take the Fed Funds to 3.5%. Do it tomorrow if you must. But do it. And then walk away. Go somewhere. Long vacation, global travel. Anything. And then come back in a year and see where the economy is. Let ‘markets be markets’. Don’t watch every monthly number. Do what Ron Popeil did, ‘Set it, and forget it.’ Come back in a year, and let’s see what happens.

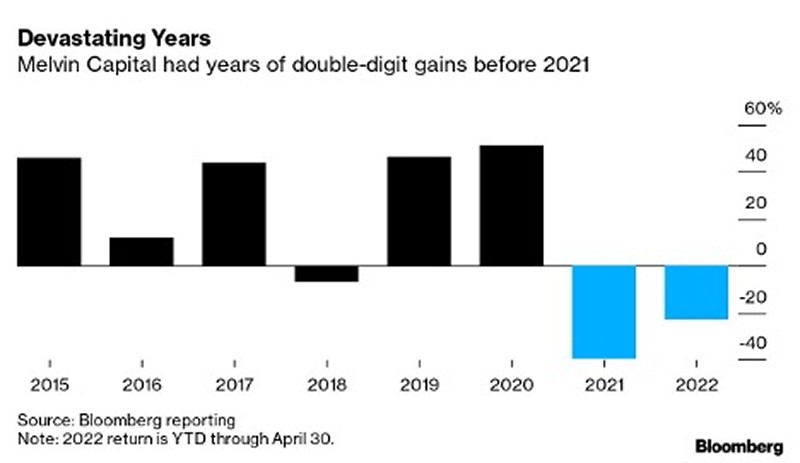

After my last post about NVIDIA might have come over less clear than I intended First off, I no longer run money, so I have no book to talk. Second, on the short side I talk ideas, but never take it as a position you should take. It’s simply too dangerous for the untrained, and often trained, to execute. Melvin Capital was a very successful short biased fund, until it wasn’t. This is the one that got most crushed by GameStop.

So, someone asked me last week when I would short NVDIA. I don’t follow it close enough to opine about what the trigger is going to be. It’s most likely the same punch list as it is for most companies. But one thing I did say was that you needed to wait until people started losing money in the stock, for it to start to go down.

When a chart starts to look like this, things tend to get a little more interesting. A failure at the top, then a failure to trade high the previous top, tends to be a place where those taking the other side want to start to get short.

I was in Palo Alto last weekend and saw a headline I had praying to see for a long time. Presidio Bay Ventures is proposing to complexly re-think this busted ‘big box’ retail space in Mountain View…

And turn it into something that looks more like this...

Now, I know nothing from nothing in the economics in mixed use real estate, but I do know that I think this is an incredible story of how to take a ten-acre site that has atrophied and isn’t’ generating cash flow into something that makes sense on a multitude of fronts.

One being the economic value of a high capacity utilization property that checks boxes like more affordable housing, even though the office space idea might not fly so well. I’m also a believer in the smaller ‘bodega’ style markets that are high yielding footprints. This is Woodlands in San Francisco, the city proper. Notice the ‘DINNERS’ case front and center. Problem solver for the high velocity Silicon Valley tech grinder.

Not that I need another ‘gig’ in my life at this point, but I do have a skunkworks idea called ‘NorthStar’ that would seek out busted big box sites and attempt to fast track them into something for today’s world. Keep in mind, it took probably twenty years for things like these to go from idea, to land acquisition, to turning the dirt, to opening, to pandemic, to ‘oooohhhhh shyte’ today. Time to ‘un-shyte’ them.

I was, per usual, on the actual physical road last Sunday for the kickoff of the NFL season. Which was good for me. Why you ask? Because I can’t for the life of me imaging what an eight hour day of watching it looks like. And everyone in my family is ‘in’. Like ‘in’ big. Fantasy, favorite teams, least favorite teams, all of it. And my guys are lightweights to the real ballers out there. The heavyweights on the other hand aren’t afraid to drop $1,600 on a season to watch it all.

The Four Sixes, an ‘old guard’ Texas cattle ranch made famous by Taylor Sheridan, has arrived in Las Vegas. That’s right, the massively popular western motif as visually crafted by Sheridan and Kevin Costner has now ‘jumped the shark’ straight into the fantasyland of Sin City.

And here are your steak dinner options. If you must ask the price, then you probably can’t afford it.

Four Sixes Ranch, Prime Steaks

Guthrie, Texas

For over 150 years, the Four Sixes Ranch has been a pioneer in the beef industry, setting the standard for excellence. Located on 260,000 acres of pristine West Texas land, this historic ranch has become synonymous with the finest Angus beef.

Filet Mignon, 9oz/12oz “Taylor’s Cut” Inside Skirt Steak, 10oz NY Striploin, 16oz

Four Sixes “Original Cowboy Spice” Crusted Boneless Ribeye, 18oz Dry Aged Cowboy Steak,* 26oz

“The Ranch Boss Cut” Porterhouse 40oz

Looks like they branded that cow so hard it went right through the skin. But who ‘cowboyed up’ and went down for the diver scallops? I doubt it was Jimmy. He’s so dumb, his daddy wished he never met his momma. That’s just solid ‘Sheridan’eque’ writing right there.