The markets, they are changing. With all due respect to Phil Collins, you can feel it coming in the air tonight, tomorrow, yesterday, in a week, and out a couple of years. Time to circle the wagons pardner and figure out what comes next, before you take an arrow to the hind quarters.

This week’s main feature is the laying out of our short thesis on Meta, the company so blatantly flawed it had to go into a truth and consequences protection program and change its name. Call us big picture, we got this one right, at least so far.

But before we do that, I wanted to read you in a cool gig I got booked next week. While I’ve stood up in a room full of suite to explain views on the markets many time, next week I get to do it in front of students at USC’s Center for Investment Studies. And this is what they are asking for, directly from the host…

|

Here’s a few topics we’ve been discussing that I’m sure they’d love to hear your views on:

- Inflation, direction of interest rates, Fed policy and the implication for markets

- Value stocks vs. growth stocks in the current environment with inflation and valuation concerns

- Potential direction of the US dollar and the impact for currency risk in overseas investments (e.g., emerging market equities)

- Is now a time to draw down risk and keep some dry powder? (I’ve talked a bit about liquid alts as a type of vehicle for this environment, they don’t have good access to much in that type of investment in the portfolio, but still an interesting topic and good connection to hedging strategies.)

- Individual stock picks or interesting story stocks – whatever you might be enthusiastic about at the moment

|

|

Without a doubt, great material for a market that is very much in transition. So next week’s commentary will be the full lecture material the students will see. That’s a cool way to do things, in my opinion. And for those in the know, they can see the irony in me heading to the belly of Southern California beast for this lecture, for I’m a died in the wool Ucla Bruin dating back to the early 90s’. But for at least one day I get to say, ‘Fight On’ and really really mean it!

With that out of the way, let’s get down to brass tacks and slay us a monster. That monster being the aforementioned Meta. Which for old times’ sake, we are going to be calling Facebook. Because, you can put all the technobabble lipstick you want on this pig, if it’s as ethically challenged, morally bankrupt, with massively flawed corporate governance, all leading to dirty profits, no amount of Fire Engine Red is going to make it pretty.

There are times in life, when the world is begging for a voice against tyranny and oppression. Against bullying and fear mongering. Against all that we believe is wrong. And today, that voice crying out is me.

Or alternatively, and more accurately, I’m just a regular Wall Street journeyman running long/short portfolios looking for stocks that I think will go down, or at least underperform for a while. In this case it’s because I, like many others, hate what Facebook represent to the world and the gentle little malleable minds of our youth. Forget David, forget Goliath, forget pigs, and forget lipstick, maybe I just want to be there to make some coin when others decide to puke their shares. I like both versions.

Full disclosure, before I jump into the deep end, this is not a valuation short (those suck), a balance sheet short (Facebook has a mountain of cash), a home to accounting malfeasance (none to speak of) or is behind the curve when it comes to product development (negative). It’s all good there. As evidence of that, look no further these employees. How can Facebook not be the best place in the world to work?

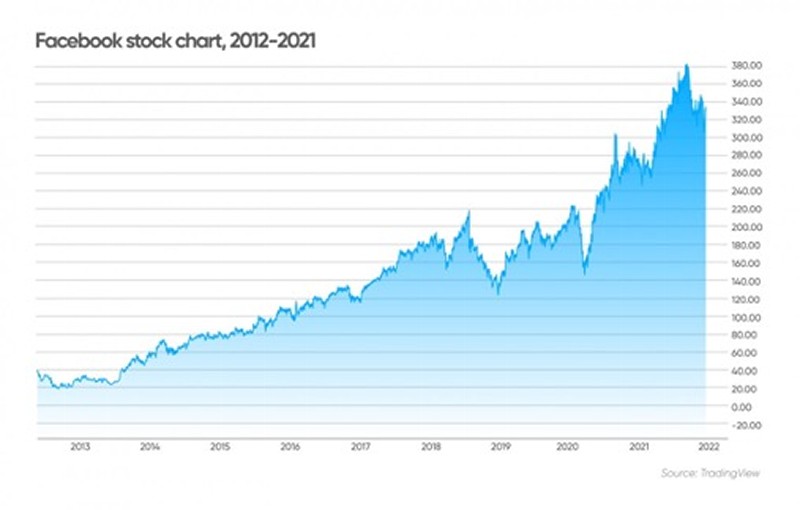

And look at this FB stock chart! How can this not be the best run company in the history of best run companies? It’s made millionaires into billionaires, paupers into princes, fueled an alumni group that is the envy of Silicon Valley, and helped hedge fund guys pay for their private jet fuel.

What is it that is so wrong with Facebook? Why such the view and the active short position? Who would do such a thing? Why, why, why? Because in a world gone insatiably hungry for social responsibility and good governance in the form of ESG funds, this company is devoid of those things. The hollow eyes of the man who birthed it says so much.

Right now, with everything that has been made public, it feels like the decisions made in the inner sanctum of the company, among its best minds, has a subliminal destabilizing impact on society, and an unknowing destabilizing impact on many of those who engage its various networks. In all honesty, all we seem to be is another brick in the wall to Zuckerberg. Haunting as that thought is.

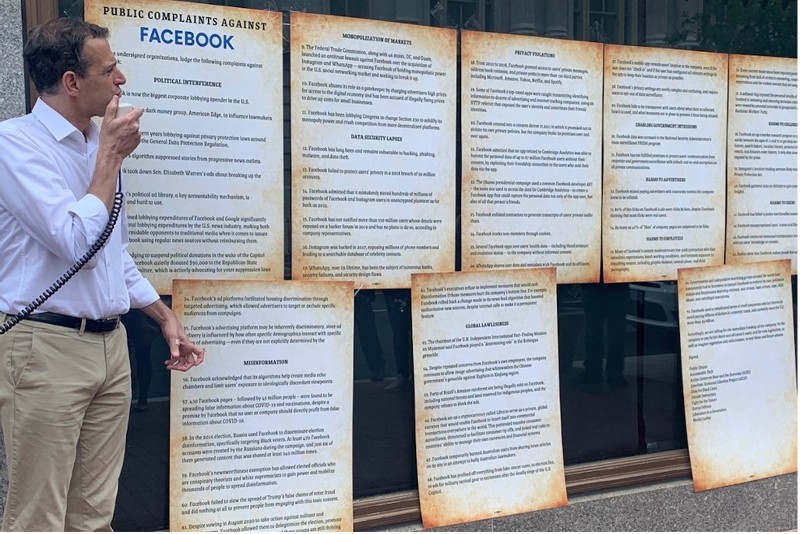

Different from an Andrew Left at Citron Research, or Carson Block at Muddy Waters, there is no hidden bookkeeping here. And again, much of what I view as negative about the company is already in the public domain. Search anything about Facebook and a laundry list of grievances of malfeasances and bad behavior shows up.

So, the critic to what I write says, ‘that’s already in the stock’. Which is fair to say. But I only loosely believe in the efficient market theory where indeed everything is viewed to be ‘in the stock’. There is simply too much subtlety around the edges of information. I’ve made decent money and later said after ‘I’m surprised that you’re surprised’ when a trend sustains itself. Companies, like people, tend not to jump from the left tail to the right tail in one quick move.

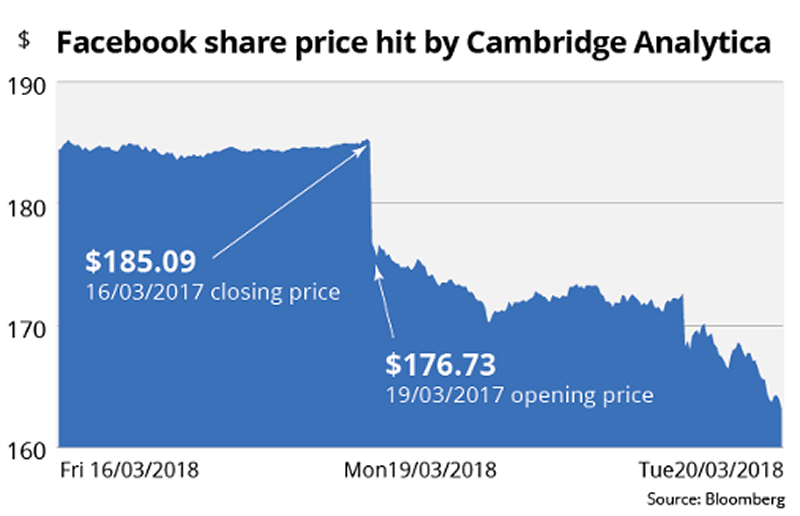

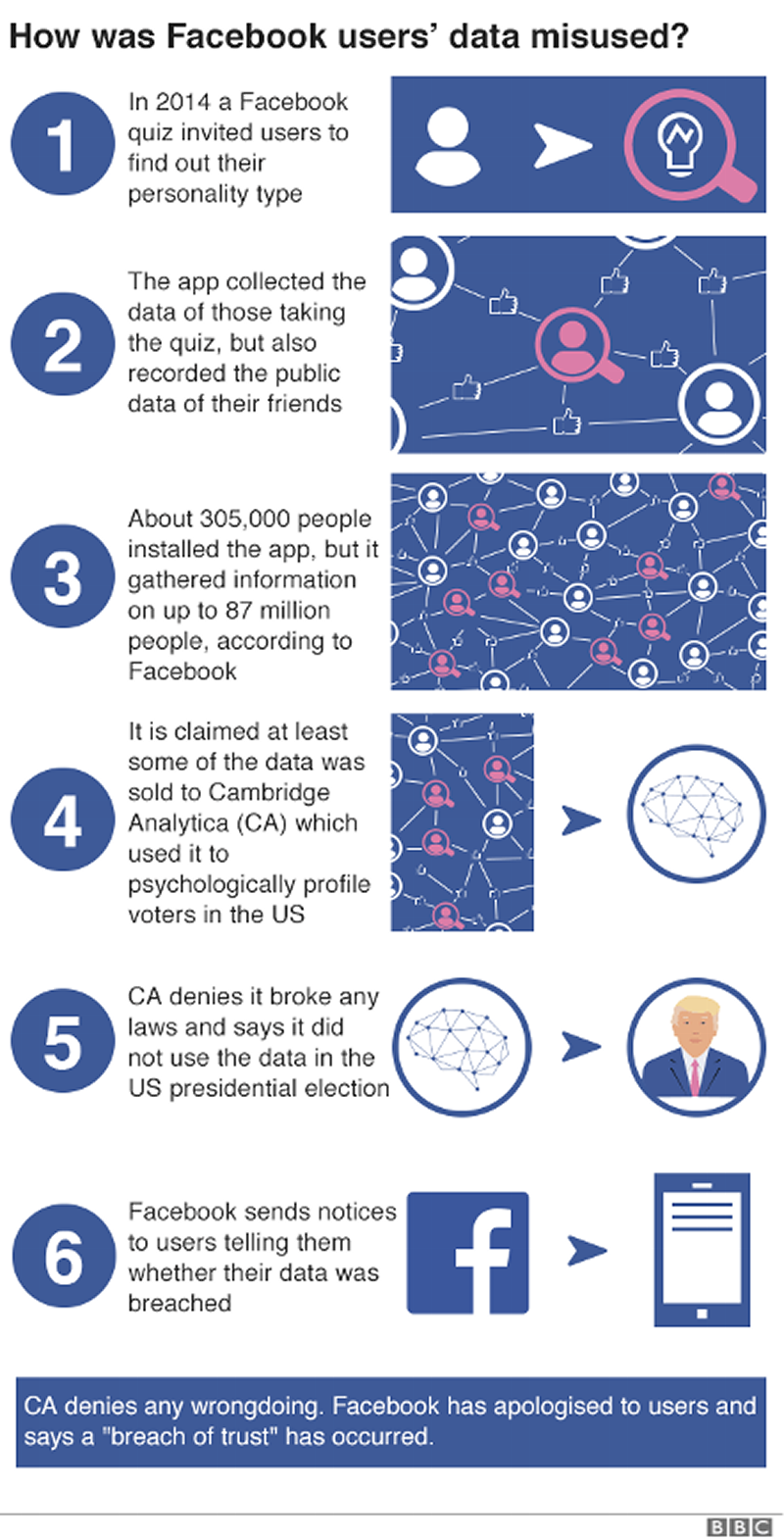

Case in point was one of the first scandals, and evidence of wrongdoing, to hit the company’s stock, Cambridge Analytica. Which was just the mellow little data breach of 87 million users of Facebook where the information found by the company was sold and used in political campaigns. Worst thing ever? For sure not. But pretty dark and bad? Very much in the affirmative.

That previous chart was of Facebook’s stock price in March of 2018. At that time, we were short the shares of the company. Prices were not great as the stock had gone up in our face for the weeks prior. But there was subtle ‘noise’ around the company playing in the background, and we thought there was for sure ‘signal’ there. And figuring out the difference in the two is the foundation of being able to see around the corners in this business.

Keep in mind, the ‘noise’ was ‘these guys are probably doing some bad shit. What we didn’t know was the actual how bad ‘signal’. But we found out and the efficient markets pounded the stock. Facebook would apologize for a ‘breach of trust’ by selling user data for political exploitation. But breaching trust is what the company does. How can you possibly expect an apology with any meaning?

At the end of the day our signal radar was working well, and we were able to use it to stick around our short position long enough that we made some money when the noise cleared, and the signal was revealed. To use a great movie analogy, this is like the famous scene in Casablanca, when Captain Renault exclaims to Rick, he is ‘shocked, shocked I tell you, that there is gambling going on in here’ and is then handed a stack of cash winnings…’oh, thank you’. For the love of God, please stop handing Facebook it’s winnings.

The idea then again in portfolio management, especially if you are trying to run long/short strategies, is to sense signal through the noise. An easy way to do this is get behind companies and management who tend to consistently give you positive signal, no matter the noise. Be long good governance and good actors, short bad governance, and bad actors. We used that as our mantra in the finance and banking sector and found a pair trade of epic proportions.

What was the trade you ask? It was long JP Morgan off its sound(ish) lending practices, clean operations as a money center bank, with the ubiquitous Jaimie Dimon at the helm. We paired that against being short the shares of Wells Fargo, where it was somehow decided that it would be cool to jam unknowing customers into loans they didn’t want or didn’t need. Had you joined in that trade, since when the scandal originally broke, you would have made 8% on the Wells short, and 147% on the JP Morgan long while sitting dollar neutral hedged position. That’s a Rembrandt of a trade.

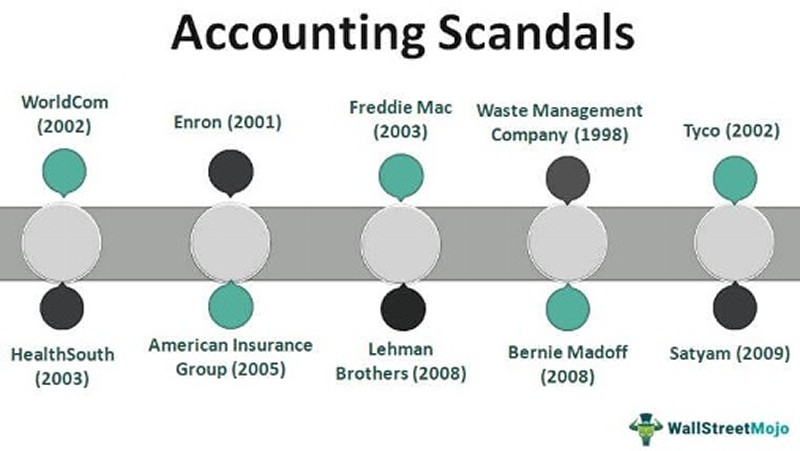

The market is full of a treasure trove of these kind of opportunities, enough that no individual position needs to dominate a portfolio. If every two years you can pull off at least ten to maybe twenty short ideas that qualify like this, that’s a pretty good haul. And if you manage to hook a whale every once and a while, the Short Selling Hall of Fame is waiting for you. We can lay claim to three on this list and will accept our invitation in due time.

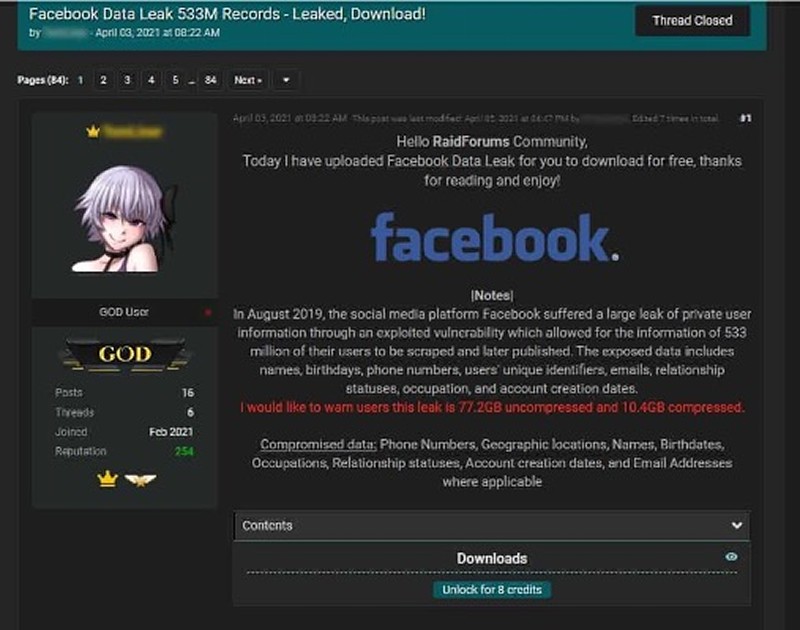

Before we go to the Facebook Files, we want to acknowledge that all the company’s wounds are not self-inflicted. The lifting of 533 million users’ personal information in 2019 was the work of an outside hacker, but the access came from a ‘vulnerability’ in software that the company should have probably known about. This is what it looked like when the hack was revealed on a forum dedicated to the practice.

Another relatively low level failure, at least by Facebook standards, was the revelation made recently that Facebook’s ‘free internet’ which is provided in mostly third world countries, wasn’t exactly free. While the ‘software glitch’ generated a scant $8 million for the company, keep in mind, that’s $8 million in third world dollars.

And now for the showstopper. In a breach of trust not seen since Cambridge Analytica, whistleblower and former employee, Frances Haugen, revealed in late 2021 that the company was well aware of the negative effects the Instagram platform was having on kids, and the really negative effects it was having on young girl’s self-image and fear of missing out.

How did Facebook know all this? They had an internal team researching the subject for three years. Yes, three freaking years. Spend 15 minutes with a group of teenage girls and you will be well read in on the damage Instagram does to the psyche of adolescents. Dick move, Michael Buble. Complete dick move!

To be clear, you don’t need to do your own research on Facebook to know they are part of an Evil Empire, The Wall Street Journal has done it for you. Their eighteen-part series entitled The Facebook Files chronicles a complete breakdown of corporate governance and control. Yes, that’s right, the eighteen-part series. If this were a college athletic program like SMU in the 1980’s, they would be given the dreaded ‘Death Penalty’ by now.

Don’t think the emergence of the negative signal from the noise has had an impact? You would be wrong. From a high of $382 in September 2021 to a low of $294 yesterday, the stock has given up 22% value in five short months. That, on its own, is a great short position.

Always keep in mind, Facebook is the ‘F’ in FANG. And while Netflix has now stubbed its proverbial toe badly, the ‘F’ was ahead of the curve. As a long/short manager I’d take a down 22% Facebook short against a long position in Google that is up 4% all day long. While that may sound a bit uninteresting to some, for those of us who practice the craft, that’s a very pretty picture. It doesn’t hurt that the NASDAQ has been sucking wind for a couple of months as well. Hedge em’ if you got em’.

Again, the critic of my thesis says everything I mentioned is in the public preview, and therefore in the stock. My response again would be that trend is trend, until it’s not. Right now, Facebook is living its life on the left tail of and no fund that wears the ESG hat can own the stock. Not even one. If they do, redeem your money today because it’s an S&P 500 hugging fraud wrapped in green wash.

A decent sized risk to getting into the short FB trade right now are fourth quarter 2021 earnings coming up on Tuesday, February 2nd. Some people successfully called Netflix deceleration and competition from other streaming services. I have nothing on Facebook like that, and in this market double digit swings in stock price post earnings is nothing, just as the aforementioned NFLX did when it dropped 20% last week.

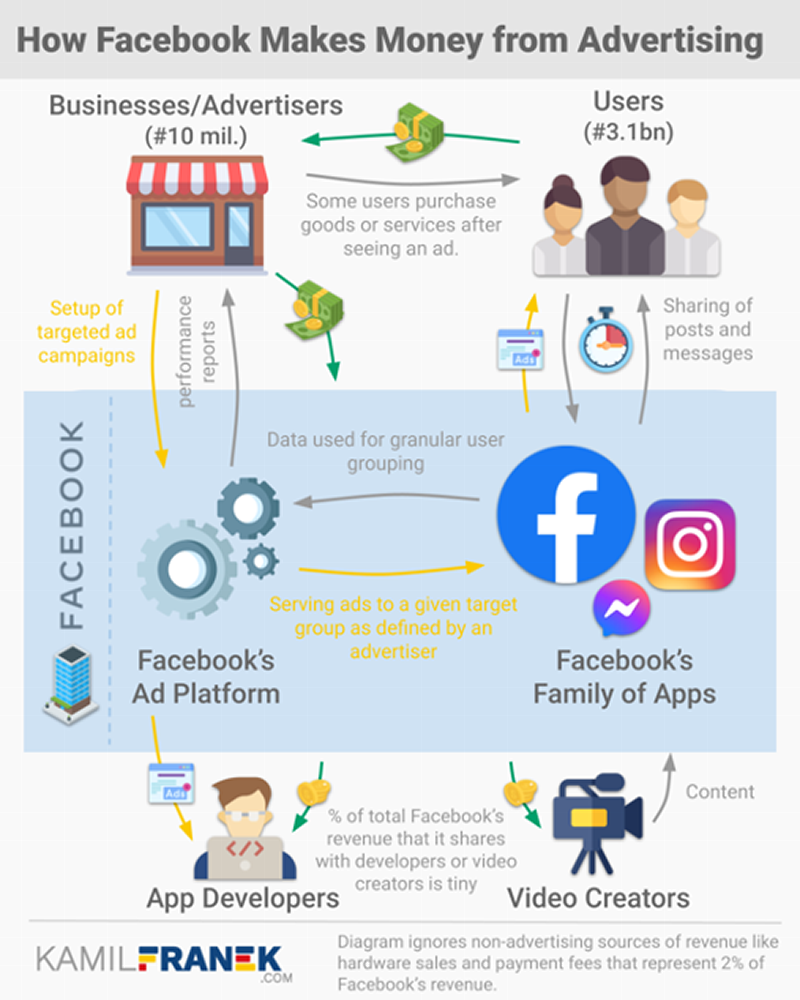

For a tutorial on how Facebook makes money, look to the really good work of Kamil Franek. A full 98% of the company’s revenue is advertising based. It’s simply a matter of which platform it comes from. As Kamil points out, it’s the depth and granularity of knowledge it has about us that makes the company so valuable.

Last thing we will point out in terms of why the company doesn’t pass the governance test is the lopsided ownership structure that gives Mark Zuckerberg 58% control of the company while owning only 29% of the shares.

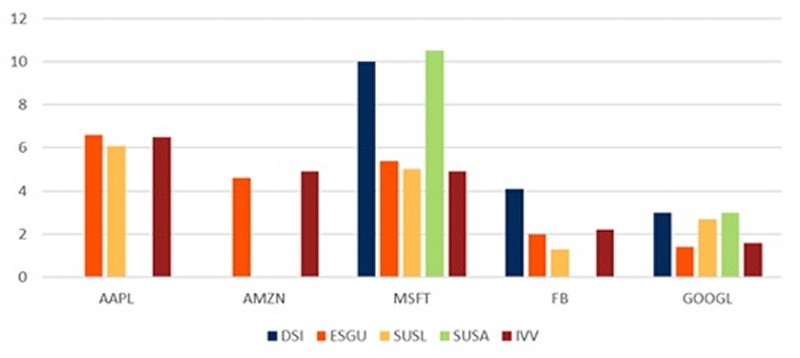

Among newly minted tech companies, dual share classes where one only enjoys the economic benefit but has no say in how the company is run is not uncommon. But in a situation where a company keeps slipping off the ethical page, shareholder influence and say is probably what’s needed to keep the kids in line. This chart comes from a ‘small little school in Boston that sits on a river.’ These things are everywhere in the tech sector with these being of 2019 vintage.

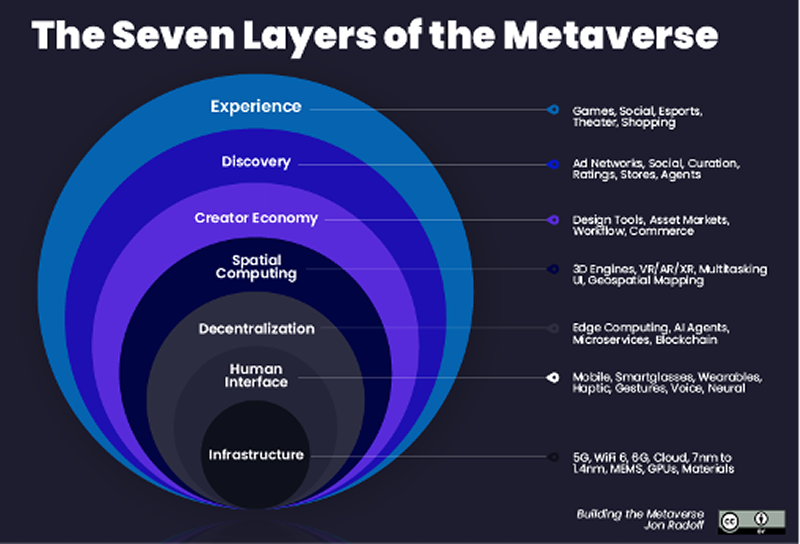

How is my thesis that Facebook deserves to be on the short list menu fall apart without changes made by the company? The market embraces Meta, and the Tron like universe it will create get hyped. Life lives in virtual reality world where everyone is connected in a way that merges layers we didn’t think could exist.

Or it’s Minecraft marries the Mall in a complete and utter distraction from Facebook’s reality. I’m certain that thesis won’t go over well with the true believers like Fidelity that just filed for an ETF that tracks companies that derive 50% of their revenues for the metaverse.

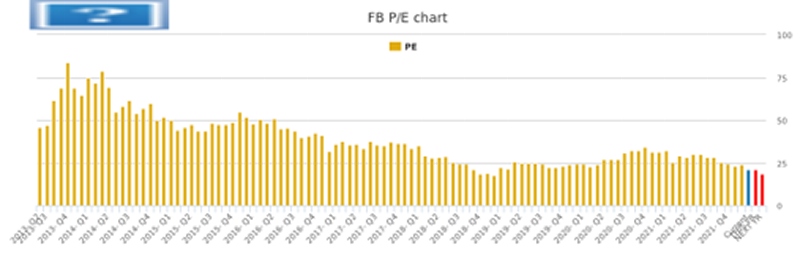

So, there you have it, my grand vision that there will continue to be noise that masks signal. But the signal will continue to emerge and be a fundamental headwind that puts a lid on the stock. Will the current 20 P/E prove attractive enough given the attempt to change stripes? Maybe. But could the shares be stuck in neutral with downside to a 15 P/E if the pain continues? Probably.

Our call is that barring a complete embrace of the metaverse, and a period of relative headline calm, the stock has more downside risk than upside potential. Buyer beware, be very aware. Because on Wall Street, its bulls, bears, pigs, and um, wimps? And the pigs that eventually get slaughtered. Lipstick wearing or otherwise. Oink, oink.