USC Marshall School

Center for Investment Studies

'Being There'

Life is about chances. Know what they look like, and be there when they show up.

March 12, 2025

USC Center for Investment Studies.

Students,

Thank you for having me on campus today with the opportunity to both impart my knowledge from 30 years in finance and Wall Street and live vicariously through you, and the futures you have together and in your careers. I had moments like this when I was an undergrad, and it wasn’t until later that I realized how important they were.

This is as much about you, in fact even more, than is about anything else. My singular goal is to have your take what we talk about today and use it to keep you on the right tail of your careers, and life. Let’s make each day our very own masterpiece.

Fight Onward!

Bryan Goligoski

Ucla Class of 1995 (and not afraid to drop it)

Journeyman Wall Streeter (drop it all the time)

For a “Bryan Buck”, who is this man? Hint, he was the author of the ‘masterpiece’ quote, and many others.

This is your starting off point. While there will be times, plenty of times, to lose sight of where you are…don’t. They tell you to never dwell on regret or missed opportunity. Better yet, don’t do things you will regret, or miss out on those opportunities. These are incredibly well manicured palm trees. Don’t let them down!

This is not bad company to be in…

Further good company to be in…

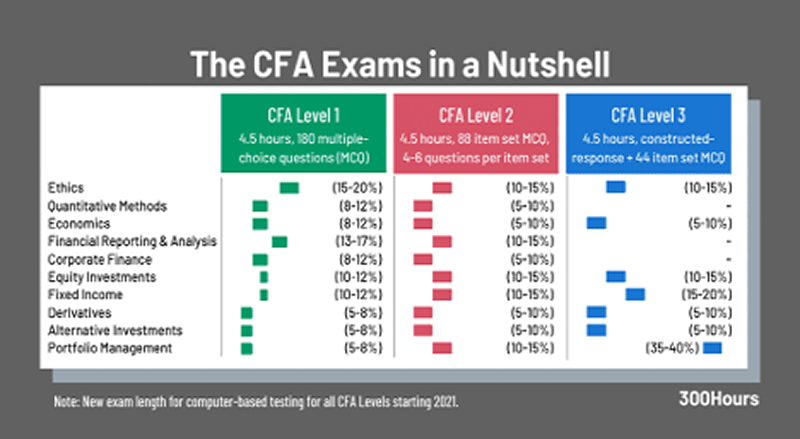

To CFA, or not to CFA? That is the question.

My own experience living a Wall Street career, 2,500 miles away from Manhattan. While possibly a reach, the Biggie v. Tu-Pac rivalry is not that far off. There are cultural and professional differences between the East Coast and West Coast experience. Privilege does not guarantee results, but it sure can open doors.

If you take one thing from this discussion, let it be the power of the bell curve. It’s a foundational way to anchor your life and career to good outcomes and bad outcomes, and of course, average outcomes. I am here to keep you center-right.

Exhibit A in what a three-sigma left tail event looks like….

Exhibit A in what a three-sigma right tail event looks like….

Today, let’s imagine this being the Bridgewater offices, where ‘radical transparency’ is a foundational belief. Your unvarnished thoughts, ideas, questions, and answers are requested.

For the second ‘Bryan Buck’ of the day, who is this man, and why is he important?

Full Disclosure: “Radical transparency” can get you fired. It did so me from four out of my last five jobs. That’s a lot of jobs, and a lot explaining to do when you are looking for number six.

My opinion and counsel were right, or at least directionally accurate each time. Every situation failed or lived up to only a fraction of its potential. While you may learn as much from failure as success, there are consequences to both. Other actors are unlikely to play by the rules of ‘radical transparency’.

As I like to say, “the narcissist (almost) always win.” That is transparent…and true. Their winning does not ensure your winning.

Paths to prosperity and professional happiness.

Public Equity

Private Equity

Career resume: Bryan J. Goligoski

1995

Graduated Ucla

Political Science Major

Business Administration ‘Emphasis’

- Accounting Minor? (Don’t ever lie on your resume!)

1996 – 2002

Strome Susskind

Global macro hedge fund, running a billion when a billion was a big number.

2004

Kodiak Capital

Lee Mikles & Mark Miller

Pride of the Sun Devil Nation

This is what the front of the house looks like…

This is the back of the house…

So, you say you want to be a short seller?

2004 – 2012

Santa Barbara Asset Management/Nuveen

Running $5 billion, when $5 billion was a lot of money.

Equity Analyst = Energy, Material, Industrial

So you say you want to be an equity analyst?

Birthed and raised a beautiful baby…Nuveen Equity Long Short (NELAX). My Wall Street masterpiece. Taken from my cold dead hand!

Performance since inception against the benchmark.

Seriously? You charge 2% for a 22.7% mega tech fund?

A horse of the Trojan kind, just not our kind.

2013 – 2015

Mercer Global Advisors

Business Development & Family Office ‘Pioneer’

Current AUM = $ 70 billion

Another ‘Bryan Bucks’ opportunity. What was Mercer’s AUM when I worked there ten years ago? Hint, a lot less.

2015

Hatteras Funds

Client Portfolio Manager

Fund of funds in a 40’ Act wrapper…at 200 basis points in fees!

2016

TCW…as old as West Coast money gets.

I no longer remember my title.

The upside…

‘Bryan Buck’ opportunity. Who is this man, and what position did he play for the Trojans?

The downside…

Stillwater…the hope and dream. Hold them tight, hold them loosely.

Analyst, portfolio manager, writer, consultant, speaker. Jack of all trades, master of some.

The Gonzo Capitalist. ‘Telling the truth and suffering the (unknown) consequences’. Publishing on Facebook, Instagram, Tick Tock, LinkedIn, etc.

The big lateral move, Oaks Culinary Group. Skinny Dips…the original seed dip.

Follow the trailblazer…

Another trailblazer….

And then the competition…

And the house brands…

And the stock price…

So…you want to be a short seller 2.0?

Beware the chaos you are trading chaos in for…

White knuckle time in the CPG business

Read from good books often. And better yet, build yourself a good book or two.

‘Bryan Buck’ time again. Who did this library belong to? Hint, two massive Wall Street firms split his name.

Reading list

Number One: 'Soros on Soros: Staying Ahead of the Curve'

A simple theory, but on that is true to this day.

Book number two: 'Make Your Bed'

One of these two guys was the highest ranking Navy admiral for a period of time, had a direct line to the White House anytime he needed it, was in charge of all the SEAL teams, and was later the President of the University of Texas, Austin. The other wears plaid shirts. Which one is which?

‘I’ll leave you with this.’