The theme for this year’s picks, pans, observations, and thoughts of the deep kind is rooted in Rock & Roll…

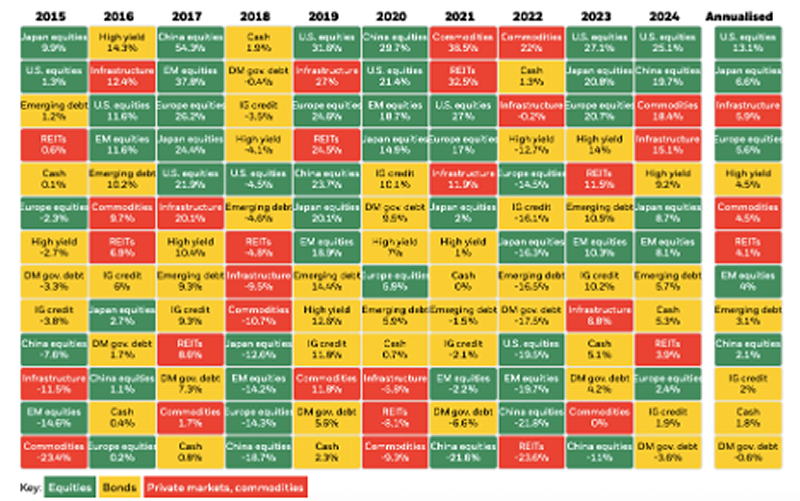

Going Zen in 2025? Yes. Letting the universe be what it will be and all that goes with it? Yes again. If I’m going to lead the charge into existential being this year, I need everyone else on board with me. That includes all those who offer themselves up as masters of the universe, with the ability to manipulate things the way they do, and controlling outcomes. Outcomes that mean you could not lose money in almost any single one of these asset classes except for China in 2023, and a small loss in developed market debt in 2024. And that’s it.

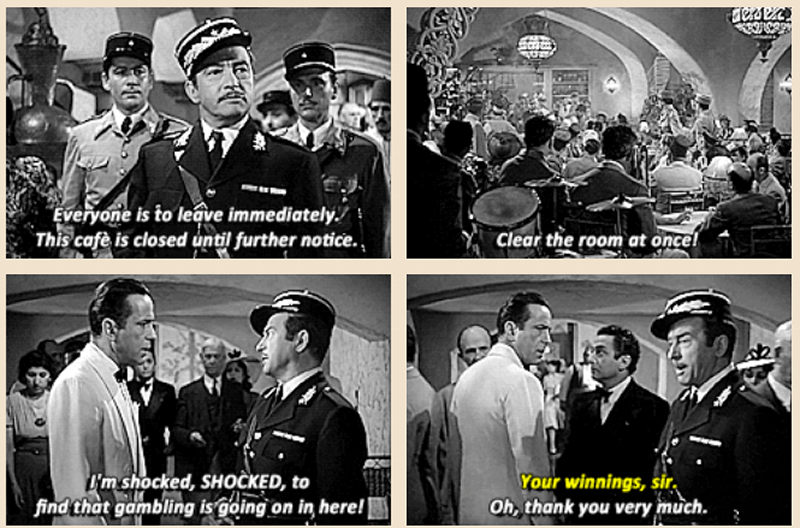

To which I like to use the second most famous quote to come out of Casablanca, 'I'm shocked. Shocked to find that gambling is going on in here.' It’s just beautiful, gorgeous, and glorious. To which I like to add, there are no crybabies allowed in the casino. If you wind up in a place where you are splitting twos at Whiskey Pete’s on a Sunday night, that’s on you.

With that, let’s jump into what the world looks like to me, a journeyman of the trade. A traveler in the shadow lands of the world of hedge funds, short selling, watching the economy, stocks and bonds. While I no longer run money, nor advise private clients, I have an amazing recollection for things that have happened, tell a mean story, and am the three-time West Coast ‘Raconteur of the Year’ Champion. That's Montana's locker I'm sitting in, deep inside the 'Stick'...I swear!

Time to drop the puck, and skate to where it’s going to be, not where it’s been. If that thought is good enough for the ‘Great One’, then it’s good enough for me.

Full disclosure: I named these things ‘observations, picks, pans and lucid ideas. I say that so that nobody reading this takes it as financial advice or something to go speculate with in the markets. If that’s your deal, then you go do you. My .800 win percentage last year, out of a stout twenty of them, should be fuel enough for you to keep reading. The scorecard for 2024...

- The Fed would start cutting rates, be long.

- A four handle for the fed funds rate by June…missed it by a month.

- It was going to be tough for hedge funds to lose money.

- The bigs would only get bigger in the world of hedge funds.

- Residential real estate would keep on rocking higher.

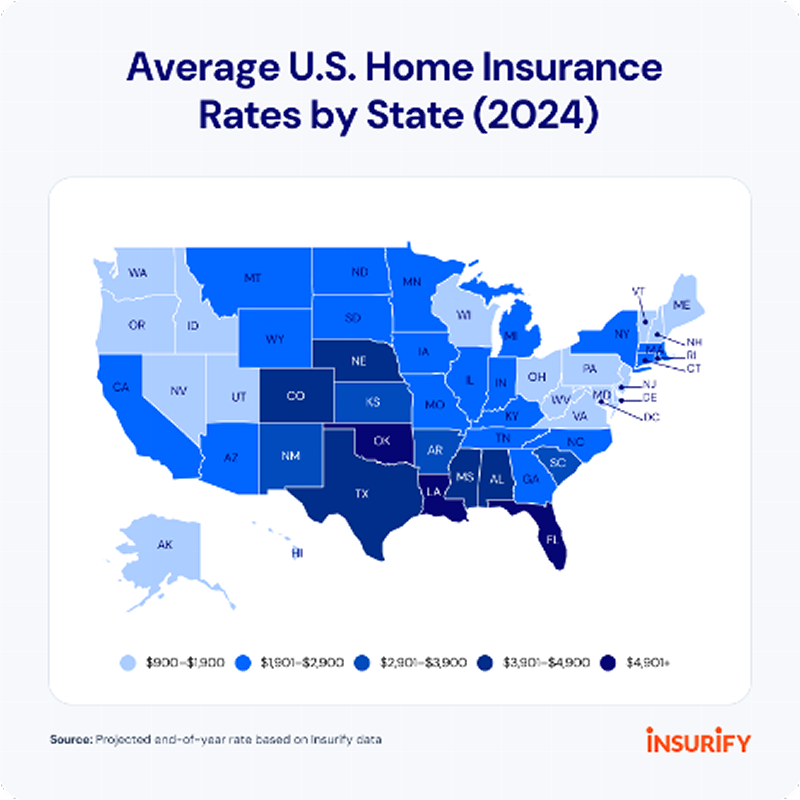

- The cost to carry a house (insurance, taxes, upkeep) would start to get painful.

- Crude oil would trade between $85 and $70 all year…it did.

- The AARK innovation fund was done going down.

- S&P 500 earnings would see a nice bump.

- Own the biggest of big tech…I’m embarrassed for myself that I wrote that.

- The claim that CPI is in retreat would be validated, not that it matters.

- The AI craze/insanity would make semiconductors a hot dot to own.

- ESG, as a canary in the woke coalmine, would start to sing...a reach.

- Unemployment would rise, and markets would like that.

- The mythical ‘soft landing’ will be upon us.

- Psylocibin would continue to get traction as a legit treatment for a lot of things.

- Yankees and Dodgers in the World Series.

- Yellowstone died and the show went to the ‘train station’ in its final year.

- Biden by a nose in an ugly one.

- I would drop that mythological 20 lbs. Didn’t happen but hope springs eternal.

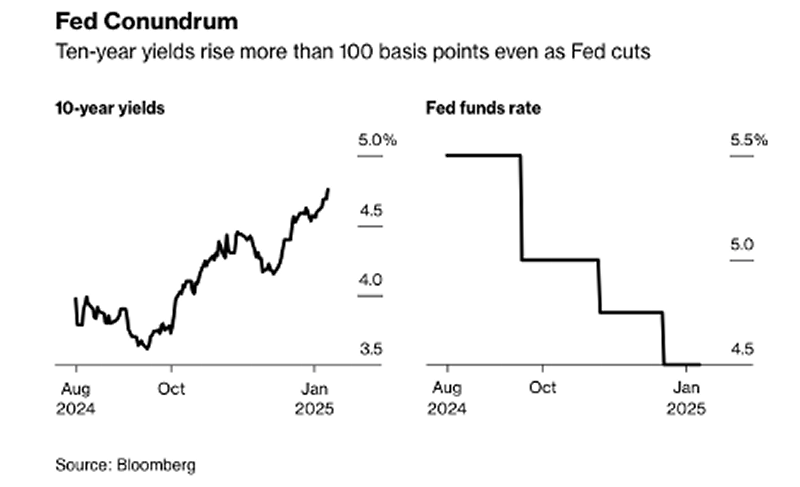

Observation number one, 2025 will be the ‘year of the bond’, as in the credit markets are going to be in charge for once. This trend started somewhat late last year as the Federal Reserve kept cutting rate but yield on treasuries rose…and rose a lot. They call them ‘bond vigilantes’, what hell shalleth they bring this year?

Number two, yields return to a newer, more progressive, normal. And I love to see this happen. If we could get the ten-year yield to average out around 5% that will go a long way to ‘normalizing’ the markets. It’s still going to take a long time in recovery for the 14 years of ZIRP addiction. But everyone must find their own bottom, and it looks like the bond market might have found it’s very own.

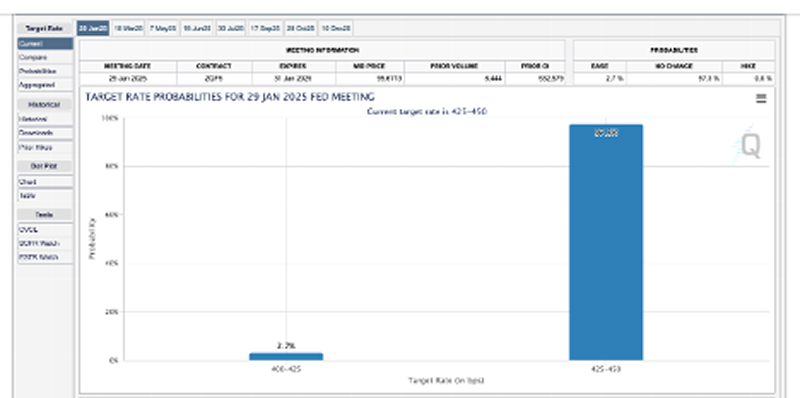

A very important number three, the January Fed meeting will be the inflection point for sobriety and they will do nothing for the next few meetings, then it’s rate hike regime part deux come mid-year. A little bold, but the Lord hates a coward.

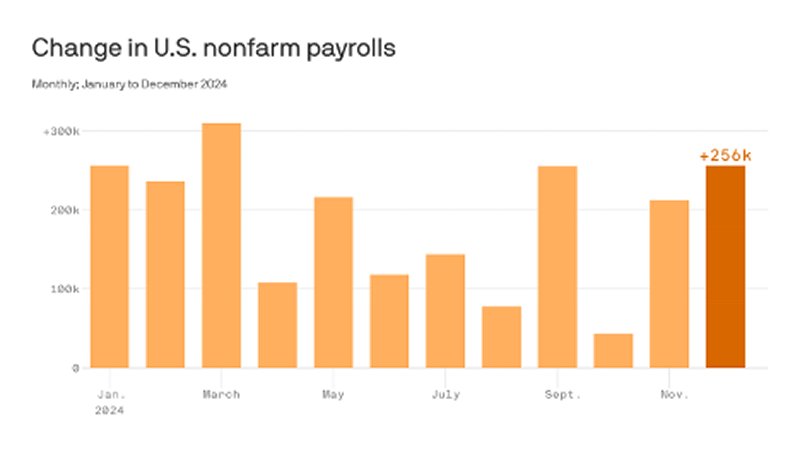

A correlated four, the labor market will continue to show little in the way of cooling. I made the reasonable observation last year that sometime in the middle of 2024 there would be a slowing in the labor market, which happened. But it was barely a blip and blips happen. But the trend these blips make, sometimes masquerades as trend.

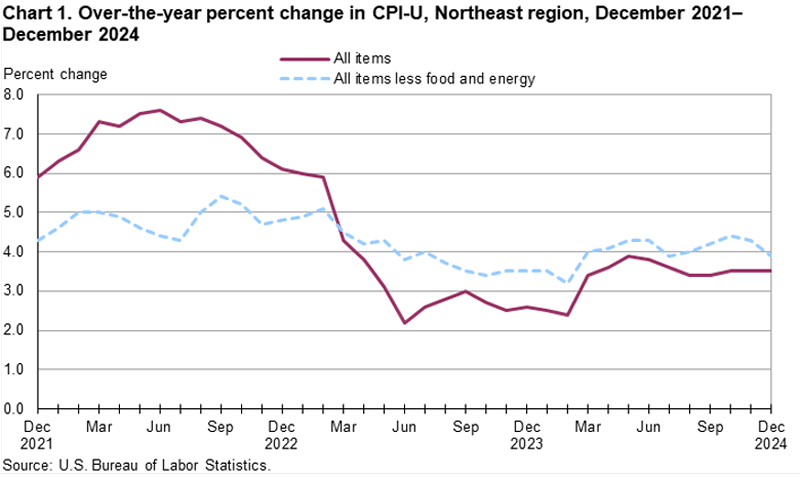

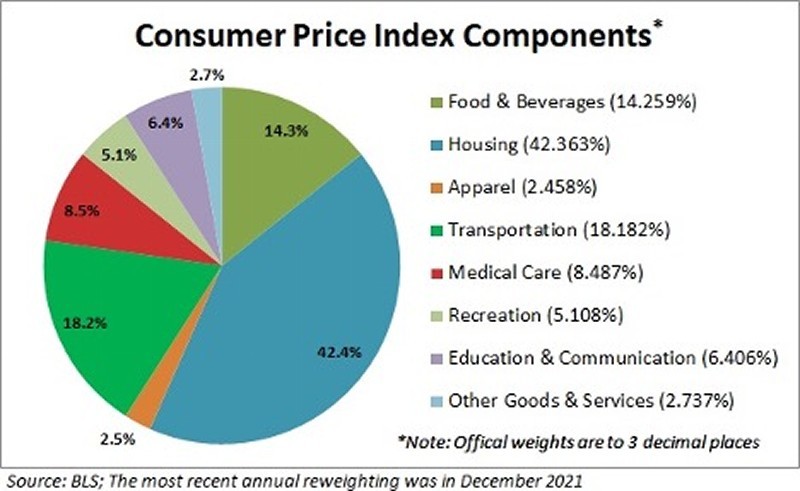

After too many years of loosely going along with CPI being the barometer of prices, this is the year I'm declaring war. Full disclosure, I am the farthest thing from a Grassy Knoll Economist, but I’ve got to call this one out. The chart below, from the BLS (Bureau of Labor Statics) might as well be a kindergarteners scribble. It’s not based on the reality of the husband and wife fearing for the mailbox, or afraid to take the car in for repairs.

The governments measure, versus reality in the markets, are twains that shall never meet. You mean to tell me that housing, which makes up 42% of the number is now going to go up 2% to 4% per year? And that it only went up 8% for roughly 24 months? I stand opposed.

So, number five is the prediction that this is the year we find out how wrong the Fed, and most everyone else was in terms of claiming that the inflation monster was dead for this cycle. It isn’t…

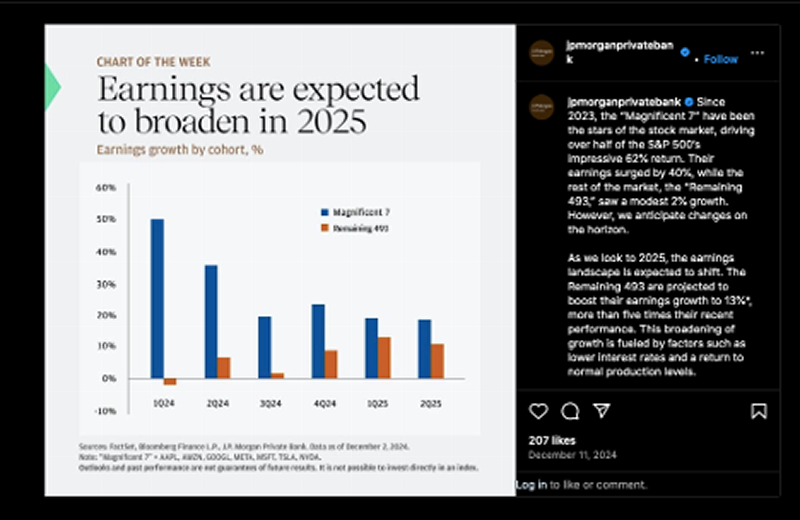

Onward to six, there will be no material earnings contraction, not that one was predicted. Another good sign that central bankers don’t need to setup the drip machine again. In fact, in the United States earnings are about to get a whole lot healthier as the 7 stocks that have mattered to own, will hand off the baton to the other 493 in the market.

Lucky number seven, because the Palisades could use some luck. If I had the dough, which of course journalists don’t, I would be levering up and getting long the Pacific Palisades. I spent ten years in LA and lived on the edge of the Santa Monica canyon looking north, dreaming of someday having a home there. With 100% certainty, the place will be back. I’ve seen it myself in smaller scale on the mean streets of Santa Barbara. But it will rise from the ashes as they say. I’m looking forward to joining my friends that call it home someday, sipping a Scorpion Bowl at the ‘new’ House of Lee, and telling stories. That’s a pretty picture…

Now lucky number eight, for Democrats, is that the people of the Republic of California hit the tipping point. Last year’s election, coupled with high taxes and massive spending on things that should not need massive spending, has added up and the dam has now broken. Is it as bad as it seems in this picture? Not for the Golden State, but this country of ours for sure took a libertarian turn right.

Full Disclosure: I suck at calling politics. In the last two years I jumped all over the place. Biden was too old, but he would win. Kamala is DOA if nominated, and she was. I also had Gavin Newsome coming in and beating Trump. Take it a step further, I at some point even said I think Trump wins. I did say that Tester was done in Montana, he was. The point being, do not bet my ‘picks to click’ in terms of politics. The outcomes are too random to create any reliable signal.

On to number nine, every ounce of effort political or otherwise, will be used to bring the price of crude down. I’m not even sure what cards are in play as it’s a strong global economy, and any production increases are going to take time. But the guy or gal who does help facilitate a new $60 to $75 range for WTI (West Texas Intermediary crude oil) is going to be king or queen. I think it’s doable, I just don’t know how.

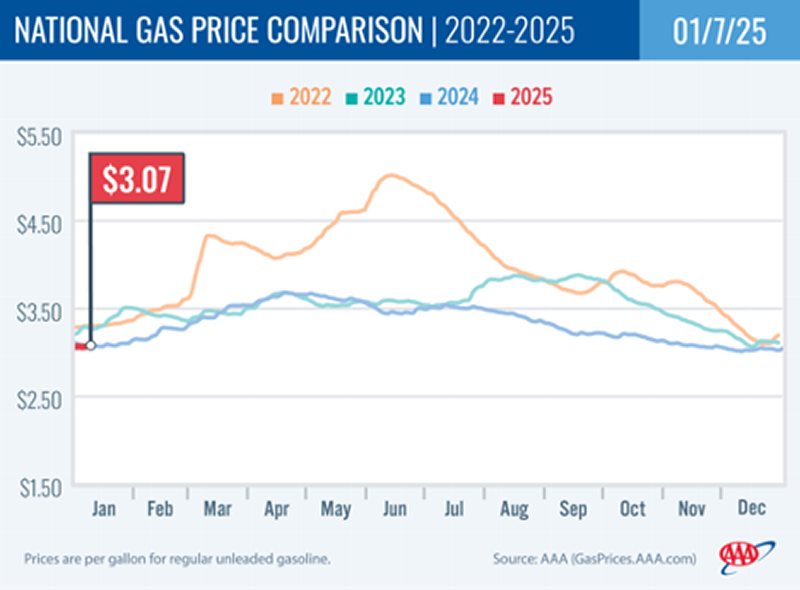

While sticker shock at the pump is still relevant, the reality is that we’ve been trending ever so slightly lower for the past two years nationally.

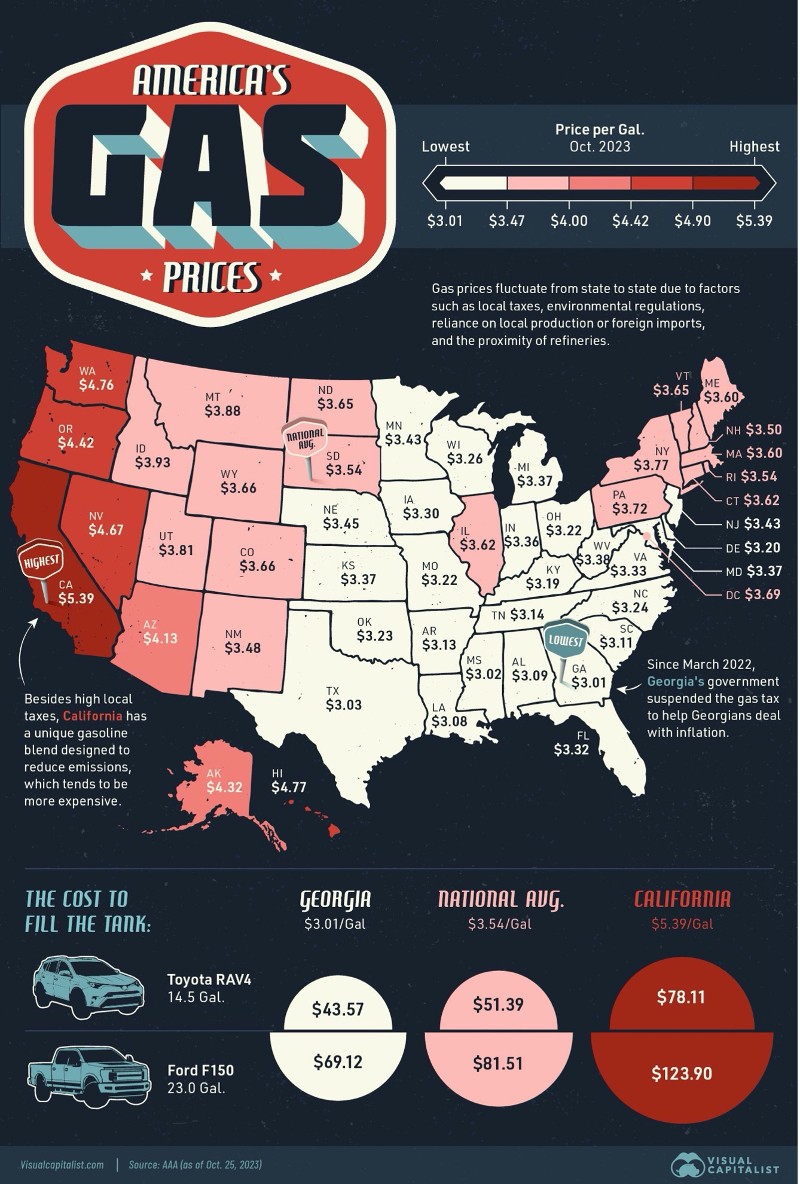

But the place it hurts the most, and it really does, is once again in California. This chart is dated as of October of last year, but the numbers are not materially different today and nor is the trend. Bottom line, you live in the apex feeder of progressive states, you pay apex feeder progressive gas prices.

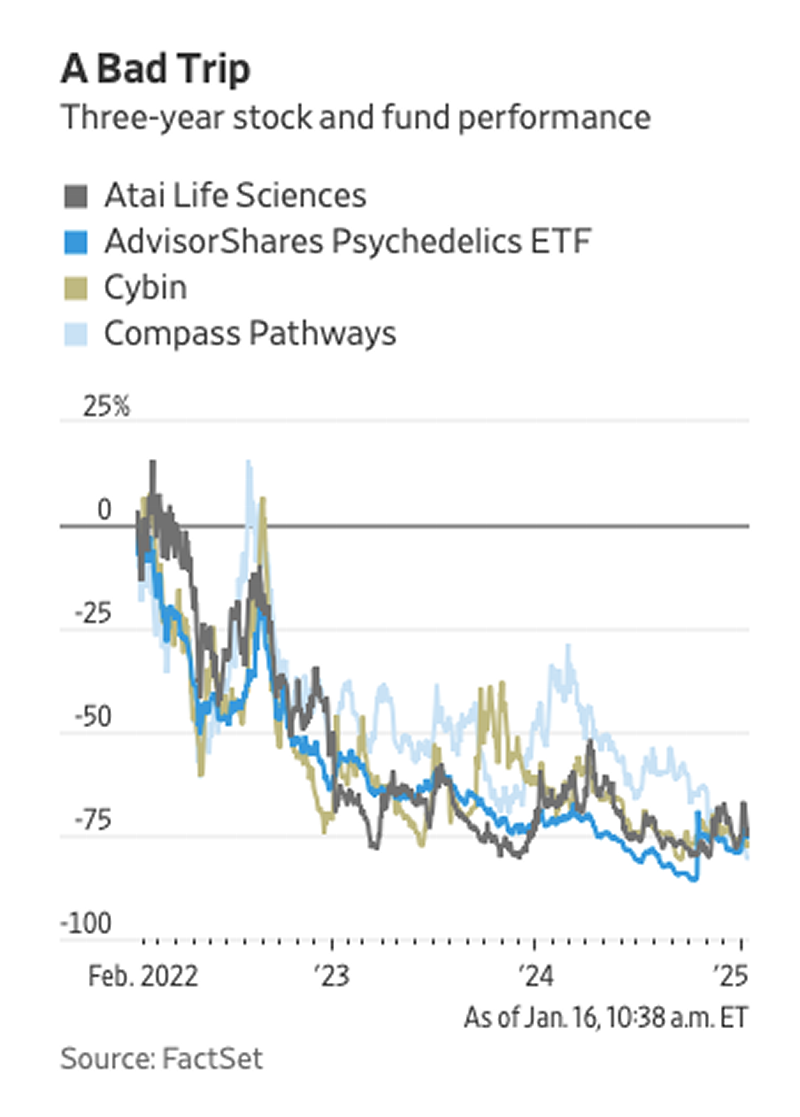

Regarding progressiveness, but one that I think is worth the fight, observation number ten is that psylocibin will have another year of making serious inroads into the global conversation about treatments for challenges of the mental health kind. My random sampling has about a third of the people I know micro-dosing mushrooms. And these aren’t just west coasters, our eastern brethren are in on it as well.

Final comment on the subject, a new ‘hot’ medical trend does not always make for a new hot stock. I haven’t peeled back the onion on these companies or funds, but they are all down 75% over the last three years, so something isn’t lining up.

Selection number eleven, and I’m almost embarrassed to write this, but 2025 is the year that the gene pool for short sellers gets so small, it can no longer reproduce and is now locked in on extinction. We lost one of our last Alpha males just this week when Nate Anderson, founder of Hindenburg Research called it quits.

I have to give the guy credit, he writes a mean epitaph. I think everyone out there can relate to some piece of this. It takes things you didn’t even remotely think you have to succeed in life. Nate found it, if not for just a little while.

But only shed a tear so much for the dying of the short seller, the rest of Wall Street’s analytical talent is also on the road to extinction. This chart, from Bloomberg, talks about the biggest investments banks on Wall Street, leaving out the buy side. But I can assure you, the same is true there.

As it’s a tough year for ideas, I’m going to go ‘putter off the tee’ with my number twelve observation. Wall Street analysts will continue to become less and less relevant. When I guest lecture at USC Marshall, I make sure to warn the students about the perils of a life in equity research, and I mean it. A couple of buddies and I that shared our talents at Santa Barbara Asset Management years ago joke that while we miss the pay and the fat benefits they handed out, we don’t really miss the job. I celebrate and cheer for all of us who successfully, or not so successfully, navigated careers out of it. Tough business.

Onward to a more serious subject. That is of Iran, the United States, and Israel. I tried to explain this to a group who were anchored to ‘presidents don’t influence the price of crude’. To which was said ‘WTF are you talking about. My specific reference was to when then President Trump dropped oil sanctions on Iran the day before they were to take effect. Oil traded down 10% immediately, Russia and Saudi Arabia now knew who was in charge. And it wasn’t the guy looking scared in this picture.

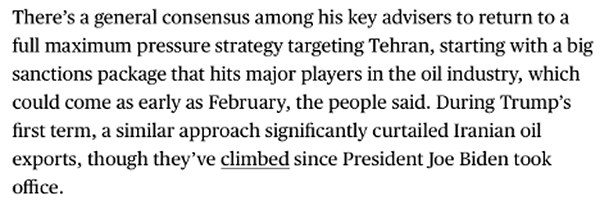

Fast forward to today, and Trump is going to go hard after Iran on the economic side, and let Israel deal with them militarily. That’s the number thirteen observation. One half of that is as obvious as Carolina not being a good football team. While I couldn’t articulate it very well, I guess, Bloomberg seems to have done the job. And the whole of the Middle East knows what’s coming next.

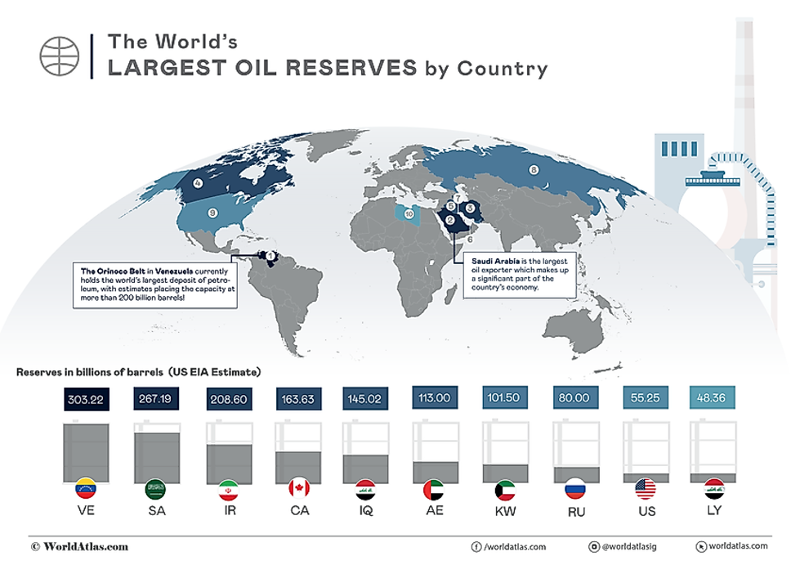

There is a decent chance that you didn’t know that Iran has the third largest deposit of oil reserves. Shut that down, and you shut down Iran economically. Because Lord knows, they aren’t making it up on tourism!

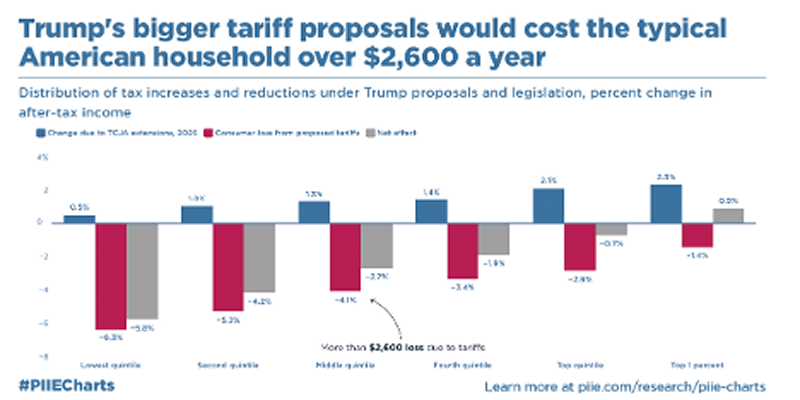

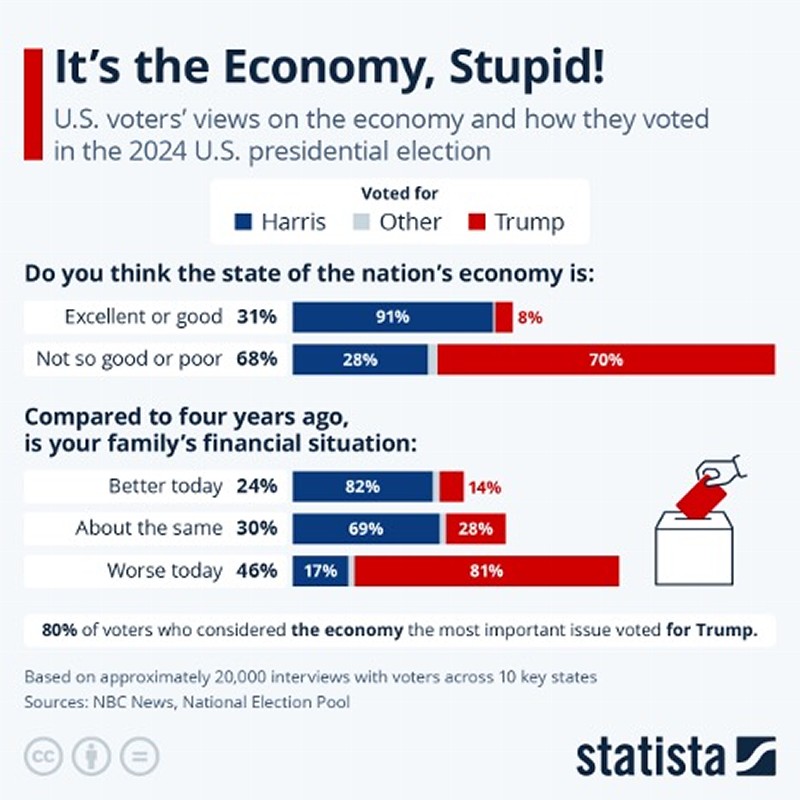

Next up is something that I don’t think most American’s have much of an understanding about. It’s the Trump plan for tariffs as he goes about putting the flex on others. That flex is going to be felt particularly hard by China, which makes all the sense in the world given the balance of trade.

Sadly, what I see happening there is my fourteenth call for 2025. That is the average Joe and Joett are going to feel the inflation hit of this far more than the top 25% of the economic pyramid. While everyone loses something in this, it’s those who can’t afford to lose the most, will indeed lose the most.

Next observation of what I think could happen, is an apolitical view. I’m as independent as they come and don’t even really watch or read much in terms of the subject. What I think I know, and it’s not a shocker, is the Democrat’s brand is in deep trouble. For reasons beyond my comprehension, in this day of the algorithm and big data, they misread the room in a way I can’t understand. Right or wrong, Trump and Co. nailed her as the Queen of Woke, and it stuck.

Why is this important to the economy and markets? Number sixteen on my list, Donald Trump has a real chance to become a very popular president. Hear that again, a very real chance to become a very popular president. If that’s the case, he has a mandate. More than the one he walked away with. There will be a boldness in his economic policy that is even more bold than before. Let the chips, and everything else, fall where they may.

Number seventeen, this will be the year of reckoning for the insurance industry. It’s out of hand, and nobody can keep up. What has happened in Altadena and Pacific Palisades, and all of California for that matter, has reached the tipping point. I have no real idea how it’s going to work itself out. But if you want to let the ‘people’ know you are on their side, then take the safety off and pull the pin if you have one to pull.

I know I buried this one deep. Number eighteen. After two years, and 24% and 23% returns, the S&P 500 finally takes a much needed breather. Maybe something in the sub 10% to make sure the Gaussian curve hasn’t fully shifted to a new normal. If you ever want to know what a ‘hell of a run looks like’ this is it!

Props to me for calling the Yankees and Dodgers in the World Series last year. I didn’t pick the winner but given the fact that it was a call made before the famous phrase ‘pitchers and catchers report to practice’ I think I did damn well.

For this year, pick number 19, I’m sticking with the Yankees as I think they want legit revenge for themselves for the complete meltdown they had in game five. A story that every Masshole (a mouthy and profane guy from New England who is now in a deep depression over the Patriots newly found irrelevance) will forever cherish and repeat again, and again, and again…

The other side of the card is not my beloved Dodgers, but the New York Mets. They came close last year, added Soto in the offseason, and Steve Cohen has an ‘at any price’ mentality for winning the World Series. And what I think happens is his team finds a way to break down Dave Robert’s multi-pitcher, multi-inning bullpen management. There is a flaw in the algorithm in there somewhere. If anyone is going to find it, it’s going to be Stevie.

Last call, number twenty, is what some might call soft. But you know what, I’m okay with that. The last five years have felt like they are moving much faster than the five years before that, and the five years even before that, etc. This year, we somehow return to the middle of the bell curve. It’s going to be just a ‘normal’ year. Some bad things are going to happen, some very good. The Palisades are for the most part in ash. A true three sigma negative event. Out there somewhere on the other side is a right tail three sigma as well. The world belongs to us. Let it be for once.