This weekend Stillwater introduces the first edition of our newest work, ‘Mid Current’. So named because someplace out in the middle of a current of water is where the bigger, smarter, and fatter fish like to hole up. While ‘This Week in the Markets’ is a quicker whip around the world of finance, if we are doing our job right, 'Mid Current' will take you out deeper to where the bigger ideas live.

One of the world’s all-time greatest traders, whose name belongs in the hedge fund hall of fame, provided us the assist to get this started off. The man in question is no other than Stan Druckenmiller, the onetime head trader for George Soros. If you don’t think Stan is worth listening to, do so at your own peril, as he put up an average return of 30% from 1981 until he handed back investors their money in 2010. And in case you hadn’t heard, he also never had a losing year.

Stan and Soros

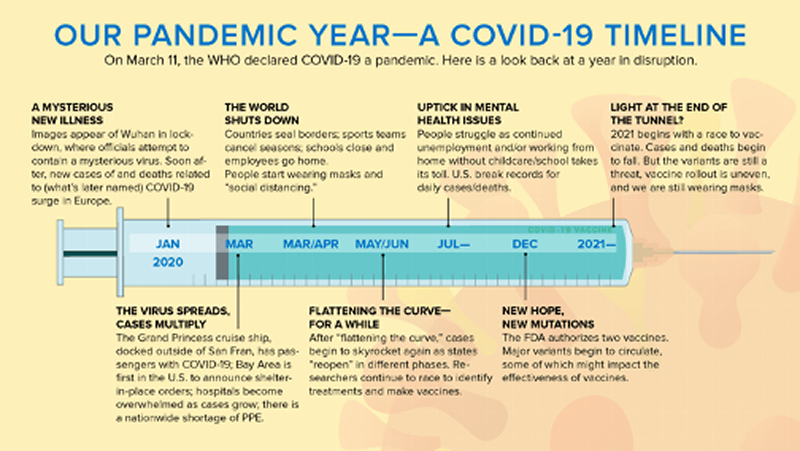

The reason Stan leads us off, is that he made an appearance last month on CNBC in the wee early morning out west (5:30 am), but it was well worth being awake for as he spoke the closest thing to the truth that we have heard out of anybody recently. The punchline was the Fed is totally out of sync with reality, and they are throwing too much jet fuel on the fire just to get 20 more basis points of inflation out of the economy. While they may have been right in doing it when the global economy was looking into abyss, the circumstances have changed, but Federal Reserve policy hasn’t.

From Bad, to (Really) Good

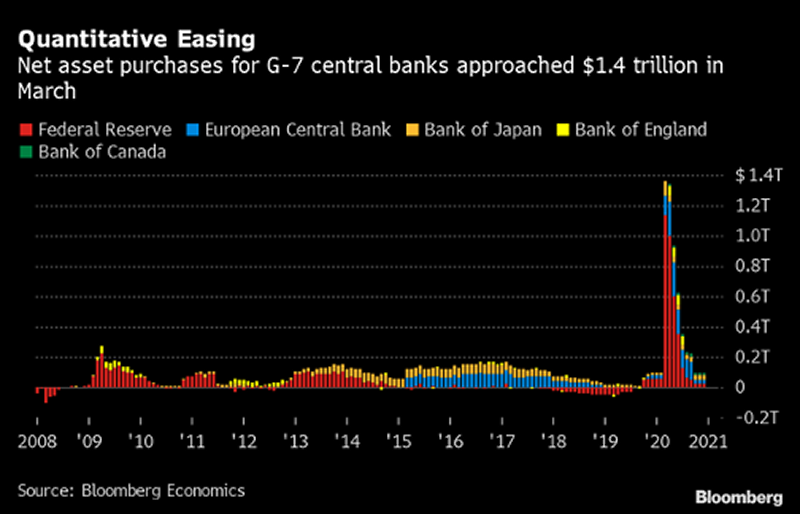

A couple of points to be made on policy decision at the Federal Reserve. First, they went BIG! Like beyond the scope of comprehension from everything we’ve known previously. As Druckenmiller points out, in six weeks during the spring of 2020, the Fed did more asset purchases than they did during all of the global financial crisis. Powell basically solved for a black hole, but it never showed up, and yet the purchasing plan continues. Looser for longer, sure, but to what end?

That’s $41 Billion a Day!

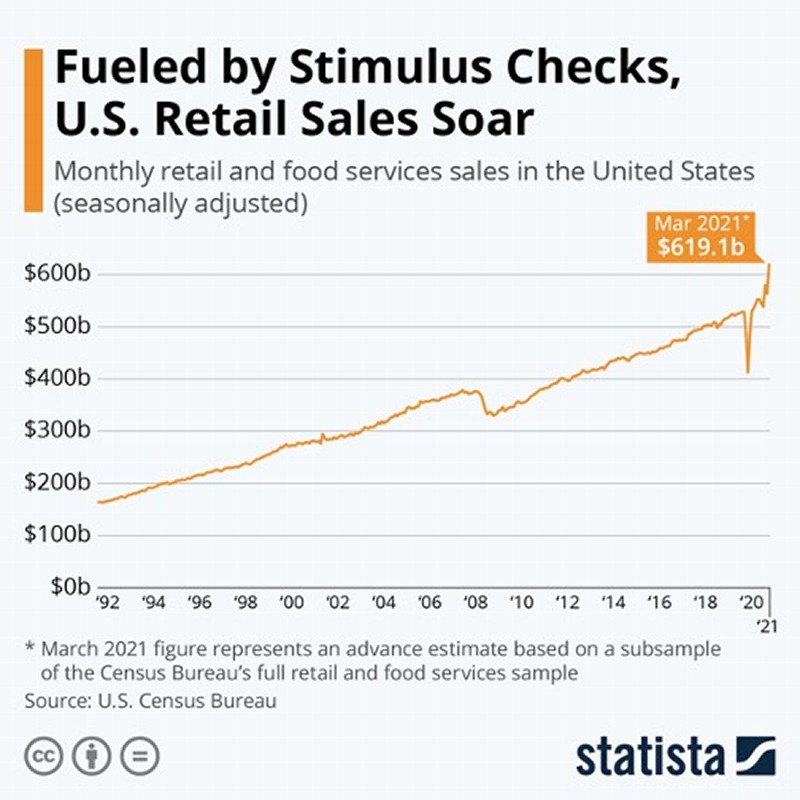

Another point Stan makes, and it’s a very good one in terms of asking what the Fed is thinking at this point, is retail sales are not only back, but they are also now way above trend line. Keep in mind, when you look at the chart notice that it took several years after the global financial crisis for things to get back to normal. Here we are talking about months. And while travel getting put on hold might explain some of this, it doesn’t explain all of it.

A $200 Billion Swing

And if you think this is a painless recovery, you are wrong. The pain being felt now is in the pinch consumers are feeling for the prices they are paying for goods, services, and assets. Last week, for the first time in my life, I put down a tri-tip I was about to buy because it was $10 more than the last time I looked. Seriously? A simple steak with three corners had gone from $20 to $30 in the blink of an eye. Thanks a lot, Jerome Powell, you just killed BBQ season.

Pour One Out

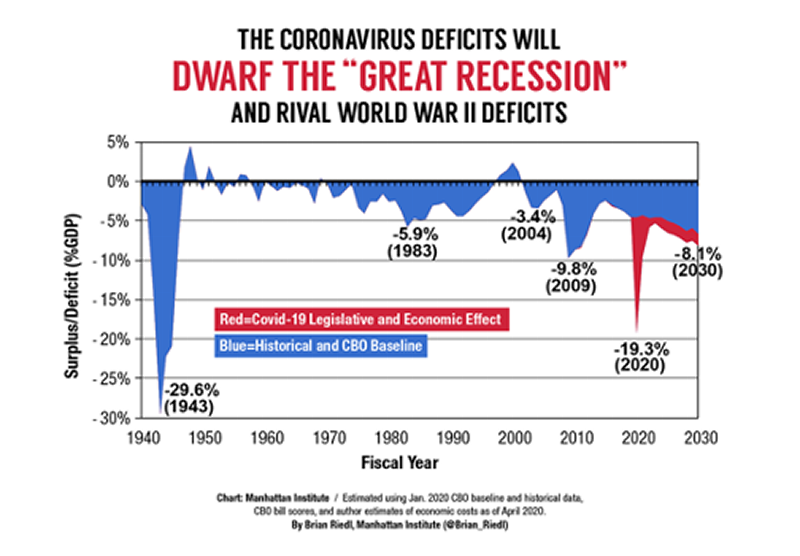

Right now, a little over a year into this, it’s free lunch for everyone. Seven days a week, twice on Sunday, and every day that ends in ‘y’ for that matter. Problem is, somebody at some point needs to pay the bill. And the reality is that when it comes due, the people who benefited the most will likely be long gone. As Druckenmiller points out, this situation is not good, will likely get much worse, and will probably cost the U.S. dollar the right to be called the world’s reserve currency. Bottom line, even if a relatively good case pans out, the United States will be running at a high level of debt relative to GDP for decades.

“Hey buddy, can I borrow a dime?”

Quick digression, the interview Stan gave on CNBC was on the same week as when his opinion piece he wrote with colleague Christian Broda, ‘The Fed is Playing With Fire”, about the Fed being out of sync ran in the Wall Street Journal. Hopefully you aren’t out of ‘free’ reads yet this month and can enjoy the content free of charge. It’s well worth the quick read. He makes the same points as he did on television, and the punchline remains the same.

“With its narrow focus on inflation expectations, the Fed seems to be fighting the last battle. Just because the Fed hasn’t faced big trade-offs in recent decades doesn’t mean trade-offs aren’t coming or that they no longer exist. Chairman Jerome Powell needs to recognize the likelihood of future political pressures on the Fed and stop enabling fiscal and market excesses. The long-term risks from asset bubbles and fiscal dominance dwarf the short-term risk of putting the brakes on a booming economy in 2022.”

To bring this full circle, and back to the idea of laying your line out in the Mid Current, let’s look at the question of what we are looking at here. For starters, the mid current of the liquidity river got about ten times as wide as it’s ever been. It’s a great metaphor for what we have seen in the past eighteen months. The middle of the river is usually tough to get to, and to find some willing Salmo Trutta even harder. But this time the middle of the river has come to you, and the 24 to 28 inch brown trout are swimming into your hand. And we don’t think that’s too much of an exaggeration.

TroutCoin

Where does that leave us? Without sounding too much like the hyperbolic Bill Walton, we are in one of the greatest asset bubbles the world has ever known. Period. Hard stop. The Fed has turned on an ‘all gas, no brakes’ policy that is going to leave a serious mark in terms of letting free markets decide the course of risk and reward. We are now living in a world where the ‘break glass’ program is the norm.

Forever Broken

Before we get to how we make money in future, let’s review. In the span of a little over a year I would be retired and flying private if I….

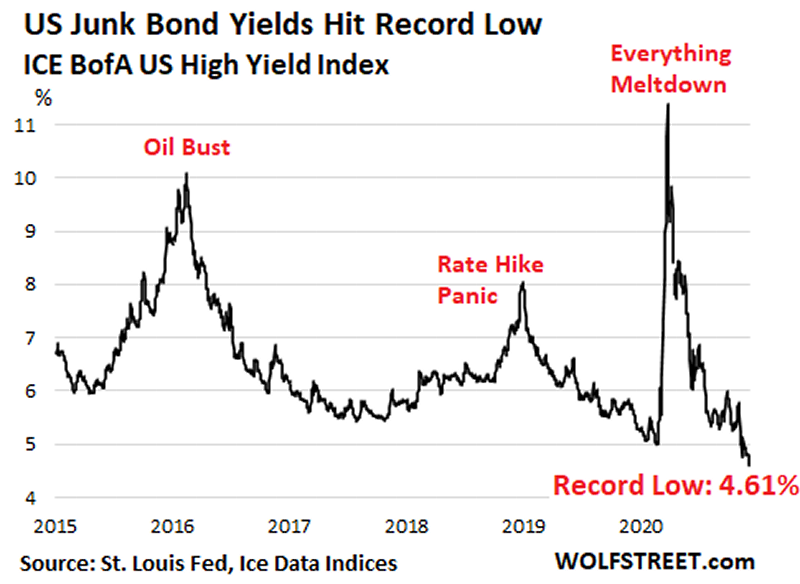

1) Had backed up the truck and loaded it with every piece of junk bond paper I could find.

‘One Man’s Junk…’

2) Speculated in a digital currency that quite literally has no intrinsic value whatsoever, but the kids seem to like trading it.

DogeCoin

3) Quit a theoretical job working for Warren Buffet at Berkshire and begged Cathie Wood to hire me.

Wood-Stocks

4) Bailed on the uber glamorous world of hedge funds and hung my shingle as a ‘lowly’ residential real estate broker.

Stan Lo = Legend

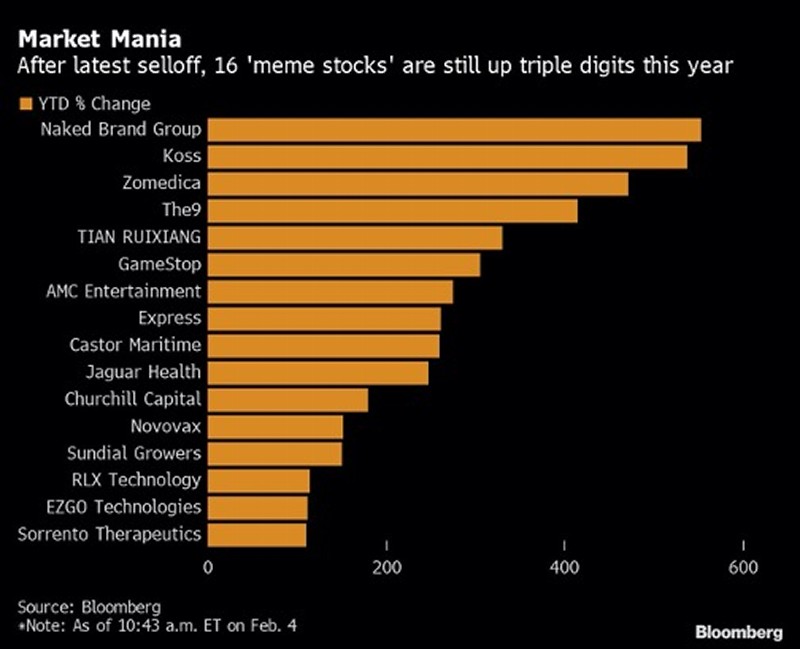

5) Sold every relatively high quality, dividend paying stock, of companies that have been around for decades, and would never go out of business because of balance sheet strength and bought a basket of ‘meme’ stocks. Whatever the hell that means!

Meme-A-Palooza

6) Owned ‘Hometown Deli’ in Paulsboro, New Jersey, which by way of a shell company structure is valued at $100,000 million on $20,000 in average annual sales.

Smoked Turkey, No Mayo

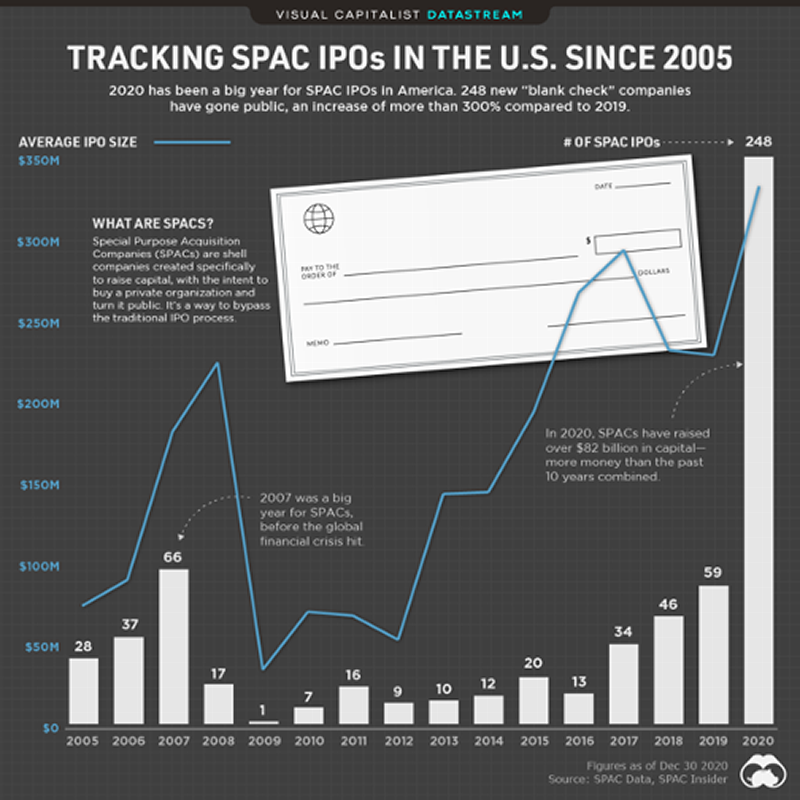

7 ) Been a Special Purpose Acquisition Corporation (SPAC) banker or had a company that I could have rolled into one.

Twelve Years in One

9 ) Anything else besides being a prudent manager of other people’s assets in alternative equity structures designed to produce lower volatility returns over the long terms, especially when the world is confronted with horrible things like a global pandemic

Worldwide Reach

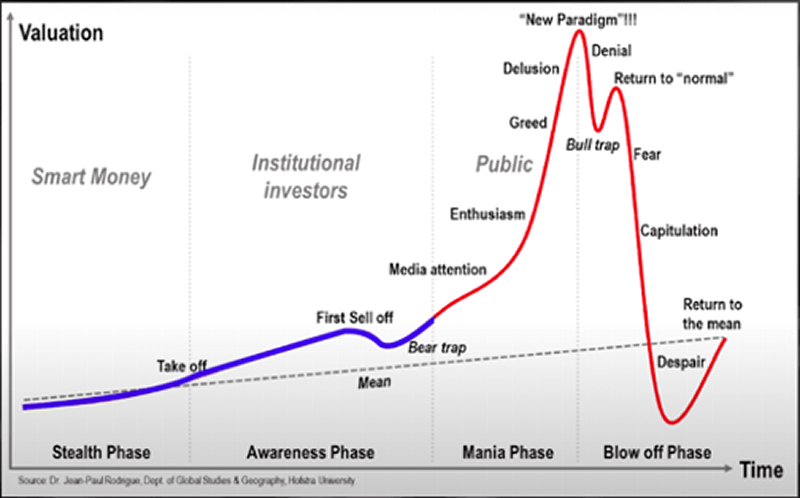

So where does that leave us, and what are we to do. For starters, let’s be clear as the day is long, we are in what can only be described as one, if not the greatest asset bubble in history. No clue if it’s the third, sixth, or ninth inning, but we would wager on it being late innings. Could be wrong, as we have been before. But this feels to us like the mania phase.

New Paradigms

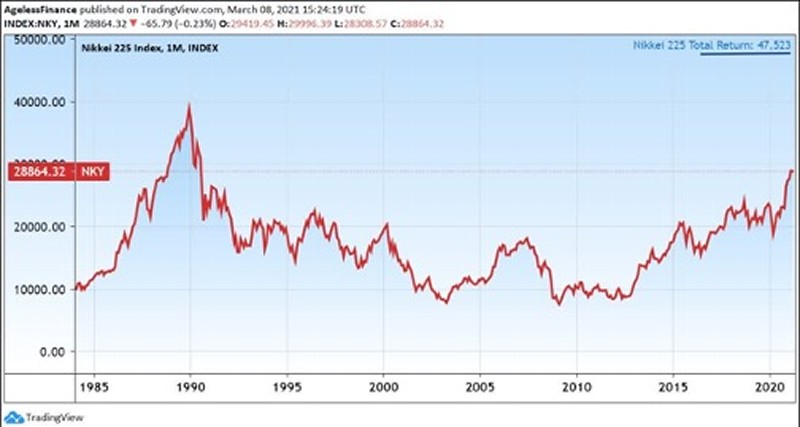

When it ends, and it will, there is a decent chance we enter into a Japan style market that does little but go sideways to down over the next several years. The timing would match up with an aging baby boomer population that is entering the draw down phase of retirement, matched by some really strong headwinds for the generation entering their 30s and 40s.

Historic Repeat?

With that we wish everyone happy hunting out there. Whether it be for houses, SPACs, digital coins based on dogs, meme stocks, or rational central bank behavior given a changed set of circumstances, we hope you find it.

Open for business as always, Stillwater will keep grinding it out, looking for opportunities on both sides of the ledger. Or at the very least our own salmo trutta, hanging out in mid current waters.

Coming for you, big dog!’

DISCLOSURE: Stillwater Capital, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Stillwater Capital, LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Stillwater Capital, LLC unless a client service agreement is in place.

Stillwater Capital, LLC provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Stillwater Capital, LLC is not responsible for errors or omissions in the material on third party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites.

General Notice to Users: While we appreciate your comments and feedback, please be aware that any form of testimony from current or past clients about their experience with our firm on our website or social media platforms is strictly forbidden under current securities laws.